Integrating Payment Gateways: Ensuring Seamless Checkout for Your Online Store

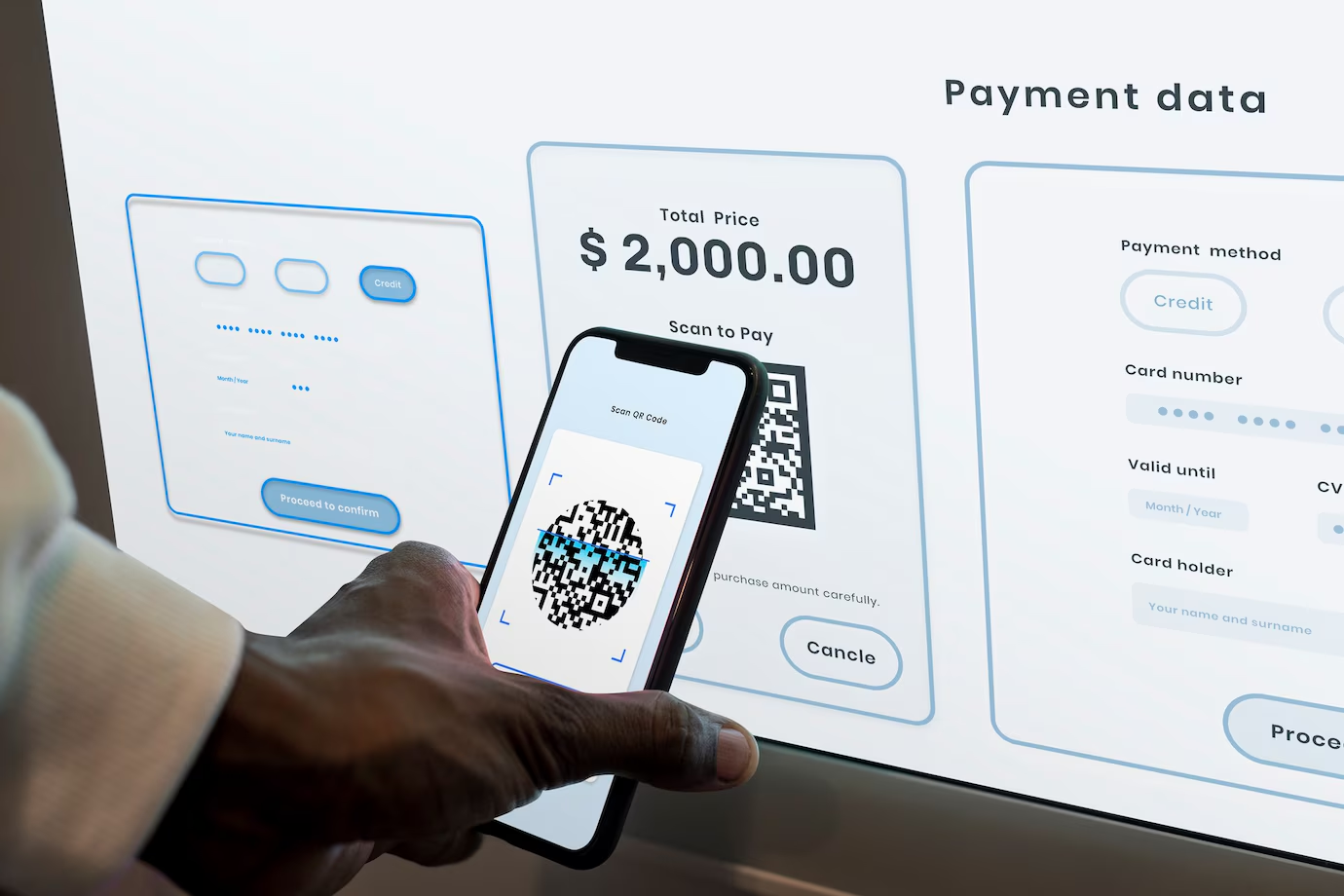

The checkout process is one of the most critical steps in the customer journey, and it can make or break the success of an online store. A seamless, secure, and user-friendly payment gateway is essential for enhancing the shopping experience and reducing cart abandonment. With the right payment integration, e-commerce businesses can build trust, provide flexibility, and cater to the diverse needs of their customers.

This article explores the importance of payment gateways, key features to look for, and best practices for integrating them into your online store. Additionally, we’ll highlight a real-world example of how offering multiple payment options helped a gourmet coffee brand reduce cart abandonment by 18%.

What is a Payment Gateway?

A payment gateway is a technology that enables secure online transactions by connecting your e-commerce website to the financial institution that processes payments. It acts as the middleman, encrypting sensitive data and ensuring that transactions are authorized and completed efficiently.

A payment gateway supports a variety of payment methods, such as:

-

Credit and Debit Cards

-

Digital Wallets (e.g., Apple Pay, Google Pay, PayPal)

-

Bank Transfers

-

Buy Now, Pay Later Services (e.g., Klarna, Afterpay)

Why Payment Gateway Integration is Crucial for E-commerce Success

An optimized payment gateway can have a significant impact on your online store's performance and customer satisfaction. Here’s why:

1. Enhances User Experience

A seamless checkout process improves the overall shopping experience. By providing familiar and convenient payment options, you can reduce friction and ensure customers complete their purchases with ease.

2. Reduces Cart Abandonment

Cart abandonment is a major challenge in e-commerce. Research shows that nearly 70% of online shoppers abandon their carts, with complicated or untrustworthy checkout processes being a leading cause. A user-friendly payment gateway minimizes these pain points.

3. Builds Customer Trust

Secure payment gateways reassure customers that their sensitive information is safe, enhancing trust in your brand.

4. Caters to Global Audiences

Integrating multiple payment options, including region-specific methods, allows you to serve customers from different countries and demographics.

5. Boosts Conversion Rates

Simplified payment processes and flexible options encourage customers to complete their purchases, directly improving your bottom line.

Key Features to Look for in a Payment Gateway

Choosing the right payment gateway is critical to achieving a seamless checkout experience. Here are the key features to prioritize:

1. Security and Compliance

Ensure the payment gateway complies with industry standards, such as PCI DSS (Payment Card Industry Data Security Standard). Look for features like tokenization and fraud detection to protect customer data.

2. Multiple Payment Methods

Offer a variety of payment options to cater to different customer preferences. Popular choices include credit cards, digital wallets, and buy now, pay later services.

3. Mobile Optimization

With a growing number of customers shopping on mobile devices, ensure the gateway is fully optimized for mobile checkout experiences.

4. Ease of Integration

Choose a gateway that integrates easily with your e-commerce platform, such as Shopify, WooCommerce, or Magento.

5. Transparent Pricing

Understand the transaction fees, monthly charges, and other costs associated with the gateway to avoid surprises.

6. Customizable Checkout

A gateway that allows for branded, customizable checkout pages enhances the shopping experience and ensures consistency with your site’s design.

Best Practices for Integrating Payment Gateways

To maximize the effectiveness of your payment gateway and reduce cart abandonment, follow these best practices:

1. Offer Multiple Payment Options

Providing a range of payment methods ensures you cater to diverse customer preferences. Include major credit cards, digital wallets, and alternative options like PayPal or buy now, pay later services. The more flexibility you offer, the more likely customers are to complete their purchases.

Use Case: Gourmet Coffee Brand

A gourmet coffee brand integrated multiple payment options, including PayPal and Apple Pay. By offering these additional methods, they reduced cart abandonment by 18%, as customers appreciated the convenience and security of familiar payment platforms.

2. Simplify the Checkout Process

Keep the checkout process as straightforward as possible. Avoid requiring users to create an account and minimize the number of steps to complete a purchase.

Tips:

-

Use a guest checkout option for new customers.

-

Automatically fill billing details when possible, reducing manual input.

-

Provide clear instructions and error messages to guide users through the process.

3. Prioritize Security

Customers need to feel confident that their sensitive data is protected. Ensure your payment gateway uses SSL encryption and fraud prevention tools.

Tips:

-

Display trust badges and certifications prominently on your checkout page.

-

Use two-factor authentication (2FA) to add an extra layer of security for high-value transactions.

4. Optimize for Mobile Users

With mobile commerce growing rapidly, your payment gateway must deliver a smooth experience on smartphones and tablets. Use mobile-friendly designs and enable digital wallets like Apple Pay or Google Pay for effortless mobile transactions.

5. Provide Localized Payment Options

For international customers, offering region-specific payment methods (e.g., iDEAL in the Netherlands or Alipay in China) can significantly enhance the checkout experience and increase conversions.

6. Test and Optimize Your Checkout Page

Regularly test your checkout process to identify and resolve bottlenecks. Monitor metrics such as cart abandonment rates, payment errors, and time-to-complete transactions.

Measuring the Impact of Payment Gateway Integration

Once your payment gateway is live, track key metrics to assess its effectiveness and identify areas for improvement:

-

Cart Abandonment Rate: A decrease in abandonment signals a smoother checkout process.

-

Conversion Rate: Higher conversion rates indicate that the payment options are meeting customer needs.

-

Average Order Value (AOV): Offering flexible payment methods like buy now, pay later can encourage customers to purchase more.

-

Customer Feedback: Collect reviews and feedback to understand how customers perceive the checkout experience.

Benefits of an Optimized Payment Gateway

Implementing a secure and user-friendly payment gateway delivers tangible benefits for your e-commerce store:

-

Improved Customer Satisfaction: A seamless checkout process leaves a positive impression, increasing the likelihood of repeat business.

-

Higher Revenue: Reduced cart abandonment and increased conversions directly impact your bottom line.

-

Global Reach: Multiple payment options and localized methods allow you to expand into international markets.

-

Brand Trust and Loyalty: Secure and transparent transactions foster trust and strengthen customer relationships.

Conclusion

Integrating the right payment gateway is a vital step in creating a seamless and secure shopping experience for your online store. By offering multiple payment methods, prioritizing mobile optimization, and ensuring top-notch security, you can reduce cart abandonment and improve conversion rates.

As demonstrated by the gourmet coffee brand, providing flexible payment options and streamlining the checkout process can lead to measurable improvements in customer satisfaction and sales. With thoughtful integration and ongoing optimization, your payment gateway can become a powerful tool for driving e-commerce growth and building lasting customer trust.

Start evaluating your payment gateway strategy today and reap the rewards of a seamless checkout experience!

Subscribe to follow product news, latest in technology, solutions, and updates

Other articles for you

Let’s build digital products that are simply awesome !

We will get back to you within 24 hours!Go to contact us Please tell us your ideas.

Please tell us your ideas.